鼎信控股基本情况

Company Overview

Decent Holding Inc. (DXST), the parent company of Shandong Dingxin Ecological Environment Co., Ltd., successfully listed on the NASDAQ on January 22, 2025, with a stock price of $4 per share, raising $5 million.

The company specializes in wastewater treatment, river ecosystem restoration, and microbial products for pollution control.

As of January 24, 2025, DXST's stock price dropped to $2.04, a 49% decline from its IPO price, with a market cap of approximately $33.15 million1.

Shareholder and Equity Structure Analysis

DXST issued 1.25 million shares at $4 each during its IPO.

The equity structure includes a mix of institutional and retail investors, though specific details on major shareholders are not disclosed.

The company’s equity distribution reflects a typical structure for newly listed firms, with potential for future adjustments as the company grows129.

Operational Capability Analysis

DXST focuses on wastewater treatment and river management, leveraging its technological expertise in microbial products.

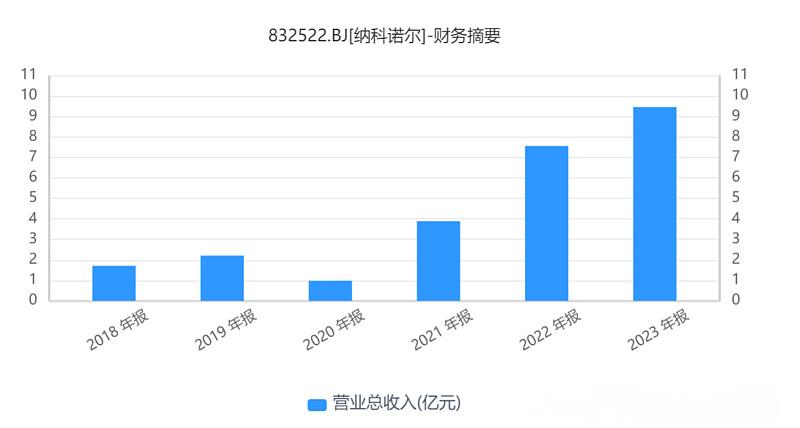

However, its financial performance shows challenges, with a 69.69% year-over-year revenue decline to $2.22 million and a net loss of $1.58 million as of April 30, 2024.

The company’s operational efficiency is under pressure, necessitating strategic improvements to enhance profitability58.

Competitive Analysis

DXST operates in the highly competitive environmental technology sector, particularly in wastewater treatment, which had a market size exceeding $21 billion in China in 2023.

The company faces competition from larger players and must continuously innovate to maintain its market position.

Despite its technological edge, DXST’s financial struggles highlight the need for stronger competitive strategies1258.

Development Prospects Analysis

The global focus on environmental sustainability presents growth opportunities for DXST.

The company’s expertise in wastewater treatment and river restoration aligns with increasing regulatory and societal demands for eco-friendly solutions.

However, DXST must address its financial challenges and expand its market reach to capitalize on these opportunities7465.

Major Events

DXST’s NASDAQ listing on January 22, 2025, marked a significant milestone.

The company’s stock experienced volatility, with a notable drop post-IPO.

Recent financial reports indicate ongoing challenges, including declining revenues and net losses, which could impact investor confidence15899.

Company Overview Summary

Decent Holding Inc. (DXST) shows potential in the growing environmental technology sector but faces significant financial and operational challenges.

Its competitive edge in wastewater treatment and river restoration is offset by declining revenues and profitability.

Investors should monitor the company’s ability to improve its financial health and expand its market presence to assess its long-term investment value.

- 最新

- 最热

只看作者