博实乐教育基本情况

Company Overview

Bright Scholar Education Holdings Limited (NYSE: BEDU) is a leading global education group specializing in K-12 education, supplementary education, and domestic kindergarten operations. With a strong presence in over 90 countries, the company operates numerous K-12 schools, art academies, language training centers, and summer schools. Despite its expansive reach, the company has faced significant challenges in recent years, including declining revenues and increased net losses 115.

Shareholder and Equity Analysis

As of the latest reports, Bright Scholar’s total share capital stands at 29.73 million shares, with common shares amounting to 118.90 million. The company has not disclosed any preferred shares. Historical data shows a consistent reduction in share capital due to the cancellation of treasury shares, indicating efforts to streamline equity structure 23.

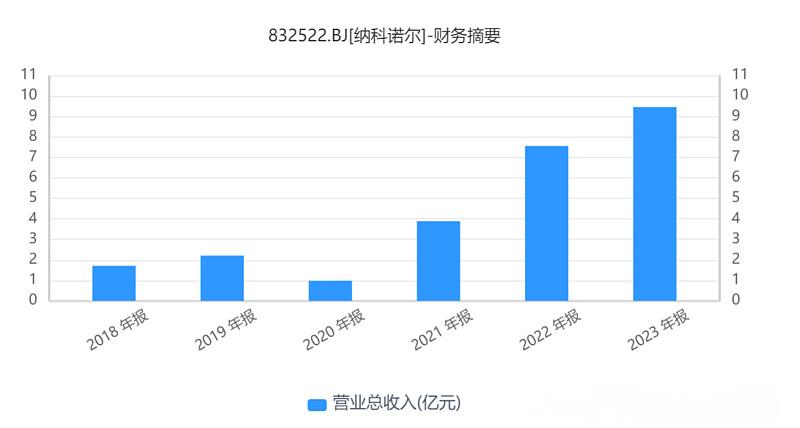

Operational Capability Analysis

Bright Scholar’s operational performance has been mixed. For the fiscal year 2024, the company reported a total revenue of RMB 1.755 billion, a slight decrease of 0.96% year-over-year. The net loss widened significantly to RMB 996 million, up 152.14% from the previous year. The company’s overseas school revenue grew by 17.5%, highlighting a potential area of strength amidst overall declining performance 1542.

Competitive Analysis

Bright Scholar faces intense competition in the global education sector. Despite its extensive network, the company’s financial performance lags behind peers. For instance, while other educational firms like VastaPlatform Limited and Afya Limited have shown positive growth, Bright Scholar’s stock price and profitability have struggled, reflecting market concerns over its competitive positioning 73.

Development Prospects

The company’s future hinges on its ability to stabilize and grow its overseas school operations, which have shown resilience. However, the broader challenges in the education sector, including regulatory changes and economic pressures, pose significant risks. Bright Scholar’s strategic focus on international markets and supplementary education services could provide pathways for recovery, but execution remains critical 176.

Significant Events

Bright Scholar has faced several critical events recently, including a failed privatization attempt and receiving a delisting warning from the NYSE due to its stock price falling below $1. Additionally, the company has undergone significant leadership changes, which could impact its strategic direction and investor confidence 94107.

Company Overview Summary

Bright Scholar Education Holdings, while maintaining a robust global presence in K-12 and supplementary education, faces substantial financial and operational challenges. The company’s equity structure has been streamlined through share cancellations, but its financial performance remains under pressure with widening losses. Competitive positioning is weak compared to industry peers, and significant corporate events have added to investor uncertainty. The company’s focus on international markets and supplementary services offers some hope for future recovery, but significant execution risks remain.

暂无评论内容