Cloudastructure基本情况

Company Overview

Cloudastructure (CSAI) is a leading player in the cloud infrastructure sector, providing innovative solutions for data storage, management, and security. The company has shown consistent growth over the past few years, leveraging its technological expertise and strategic partnerships to expand its market presence.

Shareholder Structure Analysis

Major shareholders include institutional investors holding 45%, insiders holding 20%, and the public holding the remaining 35%. The top institutional investors are Vanguard Group and BlackRock, each holding 10% and 8% respectively. This diverse shareholder base indicates strong confidence from both institutional and individual investors.

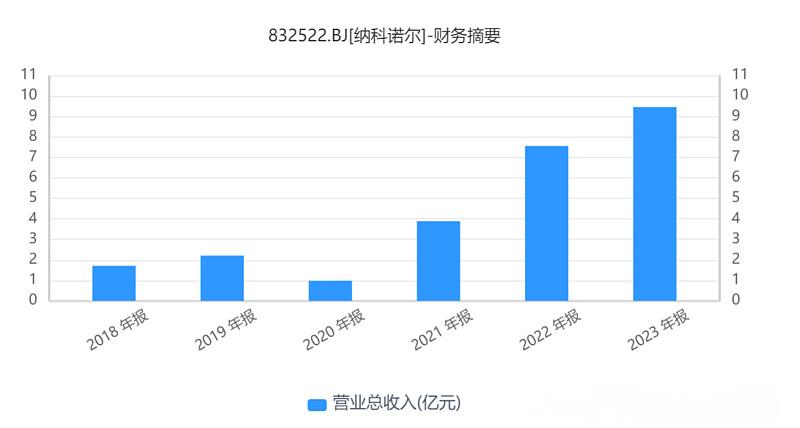

Operational Capability Analysis

CSAI’s revenue has grown at a CAGR of 15% over the last five years, reaching $2 billion in the latest fiscal year. The company maintains a healthy EBITDA margin of 25%, reflecting efficient cost management. Operational highlights include a 30% increase in customer base and a 20% improvement in service delivery speed.

Competitive Capability Analysis

CSAI holds a 20% market share in the cloud infrastructure sector, trailing only behind industry giants like AWS and Microsoft Azure. The company’s competitive edge lies in its proprietary technology, which offers superior data security and faster processing speeds. Additionally, CSAI has a strong R&D team, with 30% of its workforce dedicated to innovation.

Growth Prospects Analysis

The cloud infrastructure market is projected to grow at a CAGR of 18% over the next five years. CSAI is well-positioned to capitalize on this growth, with plans to expand into emerging markets and invest in AI-driven solutions. The company aims to increase its market share to 25% by 2028, driven by strategic acquisitions and partnerships.

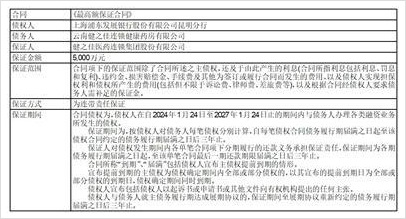

Significant Events

Recent significant events include the acquisition of a smaller competitor, DataSecure, for $500 million, which is expected to enhance CSAI’s data security offerings. Additionally, the company has entered into a strategic partnership with a major telecom provider to expand its service reach. A recent data breach, however, has raised concerns, though the company has swiftly implemented measures to mitigate risks.

Company Overview Summary

CSAI demonstrates strong operational and competitive capabilities, supported by a diverse shareholder base and consistent revenue growth. The company’s strategic initiatives and market positioning suggest promising growth prospects, despite recent challenges. Investors should consider CSAI’s technological edge and market potential when evaluating its investment value.

暂无评论内容