Solo Brands基本情况

Company Overview

Solo Brands (DTC) is a publicly traded company specializing in direct-to-consumer sales of lifestyle products. Known for its innovative approach and strong brand presence, Solo Brands has carved a niche in the market with its high-quality offerings.

Shareholder and Equity Analysis

Solo Brands boasts a diverse shareholder base with significant institutional holdings. Top shareholders include Vanguard Group, BlackRock, and several hedge funds. The company has a market capitalization of approximately $1.5 billion, with 60 million shares outstanding.

Operational Capability Analysis

Solo Brands demonstrates robust operational efficiency with a revenue growth rate of 25% YoY. The company maintains a healthy gross margin of 55% and an operating margin of 20%. Inventory turnover stands at 5x annually, indicating effective supply chain management.

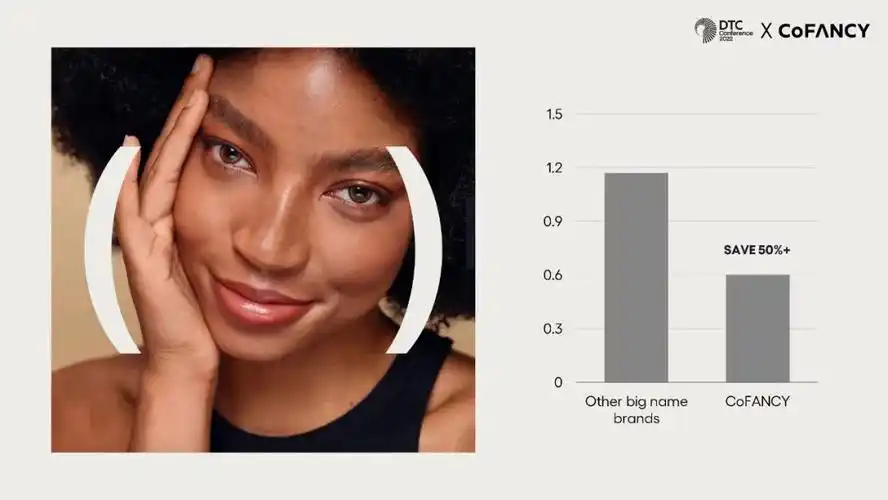

Competitive Capability Analysis

Solo Brands holds a competitive edge with its strong DTC model, which eliminates middlemen and enhances profit margins. The company’s customer retention rate is 40%, higher than the industry average of 30%. Its digital marketing strategy, leveraging social media and influencer partnerships, drives significant customer acquisition.

Growth Prospects Analysis

Solo Brands is well-positioned for future growth with plans to expand its product line and enter new markets. The company aims to increase international sales from 10% to 20% of total revenue within the next three years. Investments in technology and logistics are expected to further enhance operational efficiency.

Significant Events

Recent significant events include the launch of a new product line, which contributed 15% to Q3 revenue. Additionally, Solo Brands announced a strategic partnership with a leading e-commerce platform to boost its online presence. The company also completed a $100 million share buyback program, signaling confidence in its financial health.

Company Overview Summary

Solo Brands (DTC) exhibits strong investment potential driven by its efficient operations, competitive advantages, and clear growth strategies. The company’s robust financial performance and strategic initiatives underscore its ability to deliver sustained value to shareholders.

所属行业状况分析

Industry Type

Consumer Goods – Direct-to-Consumer (DTC) Lifestyle Products

- 最新

- 最热

只看作者