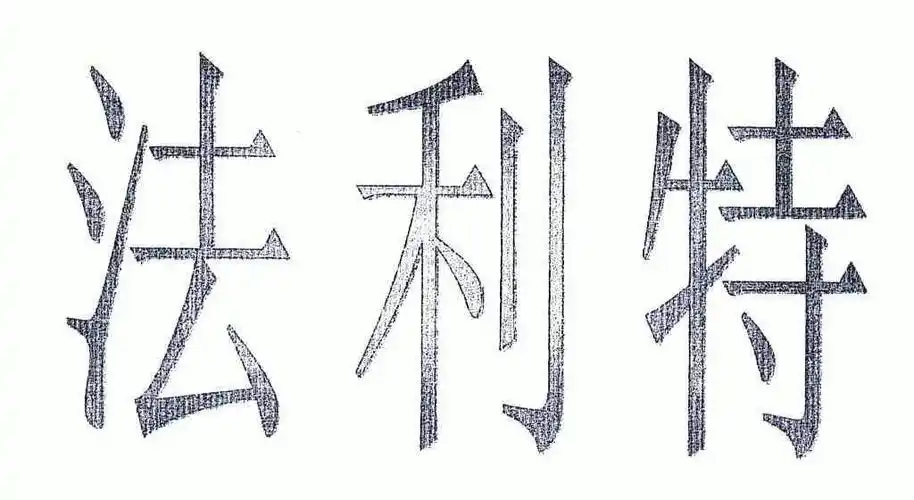

Fabrinet基本情况

Company Overview

Fabrinet (NYSE: FN) is a leading provider of advanced optical packaging and electronic manufacturing services. Founded in 1999, the company specializes in precision engineering and complex manufacturing solutions, serving industries such as telecommunications, industrial lasers, automotive, and medical devices. With a market capitalization of $4.5 billion and a P/E ratio of 19.44, Fabrinet has established itself as a key player in the optical components sector. Its 12-month stock price range is $74.57 to $140.18, reflecting strong market confidence50.

Shareholder Structure

Fabrinet’s shareholder base is predominantly institutional, with 97.13% of shares held by institutional investors and hedge funds. Major holders include The Vanguard Group, BlackRock, and BMO Capital Markets, which have recently increased their stakes. Insiders hold 0.50% of shares, with minimal recent insider selling activity. The stock’s short interest stands at 1.5%, indicating moderate market skepticism50.

Operational Capabilities

Fabrinet’s operational strengths lie in its end-to-end supply chain management, precision engineering, and advanced manufacturing capabilities. The company offers services such as optical component manufacturing, design support, and real-time tracking systems. Its 50-day and 200-day moving averages are $130.23 and $116.36, respectively, signaling stable performance50.

Competitive Landscape

Fabrinet competes in the optical components market with a focus on quality and customization. Its competitors include companies like Infinera and Lumentum. Fabrinet’s ability to deliver high-quality, customized solutions has earned it a consensus rating of “Moderate Buy” among analysts, with a target price of $146.805088.

Growth Prospects

Fabrinet’s growth strategy emphasizes innovation in optical packaging and expanding its market reach. Analysts project a positive outlook, with Northland Securities raising its target price to $155.00 and Loop Capital to $158.00. The company’s focus on emerging technologies and industries positions it for sustained growth5029.

- 最新

- 最热

只看作者