2x Solana ETF基本情况

Situation Overview

Volatility Shares 2X Solana ETF (SOLT) is an exchange-traded fund launched by Volatility Shares LLC, based in Florida. It provides 2x leveraged exposure to Solana futures. As of its debut, SOLT had a management fee of 1.85%, higher than the 0.95% fee for its non-leveraged counterpart, SOLZ. On its first trading day, SOLT declined by 3.84%, indicating potential volatility. Solana, the sixth-largest cryptocurrency by market cap, is valued at approximately $67 billion, positioning SOLT as a key player in the emerging crypto ETF market.

Shareholder Analysis

SOLT is managed by Volatility Shares LLC, a Florida-based entity specializing in ETFs. The fund's shareholder structure is primarily institutional, targeting investors seeking leveraged exposure to cryptocurrency futures. The higher management fee of 1.85% reflects increased operational costs and risk management associated with 2x leverage. As of the latest data, SOLT's market capitalization stands at $139.11 million, with a circulating share count of 100,000.

Operating Capability Analysis

SOLT's operating capability is characterized by its unique 2x leverage structure, which amplifies both gains and losses. The fund's management fee of 1.85% indicates higher operational complexity compared to traditional ETFs. Key metrics include:

-

Market Cap: $139.11 million

-

Management Fee: 1.85%

-

Performance on Debut: Down 3.84%

-

Leverage: 2x exposure to Solana futures

These metrics suggest that while SOLT offers high potential returns, it also carries significant risk, making it suitable for sophisticated investors with a higher risk tolerance.

Competitive Analysis

SOLT competes in the niche market of leveraged cryptocurrency ETFs. Its primary competitors include:

-

Volatility Shares Solana ETF (SOLZ): Offers 1x exposure with a lower management fee of 0.95%.

-

Other Crypto ETFs: Mainstream ETFs tracking Bitcoin and Ethereum futures.

SOLT's 2x leverage distinguishes it by catering to investors seeking higher returns, albeit with increased risk. The higher management fee reflects the added complexity of managing leveraged positions. Its competitive edge lies in providing amplified exposure to Solana, a cryptocurrency gaining traction in the DeFi space.

Development Scenario Analysis

The development potential for SOLT is tied to the broader adoption of cryptocurrencies and regulatory clarity in the U.S. market. Key factors include:

-

Regulatory Environment: The U.S. government's inclusion of Solana in its strategic crypto reserves signals regulatory support.

-

Market Trends: Growing institutional interest in cryptocurrencies could drive demand for leveraged ETFs.

-

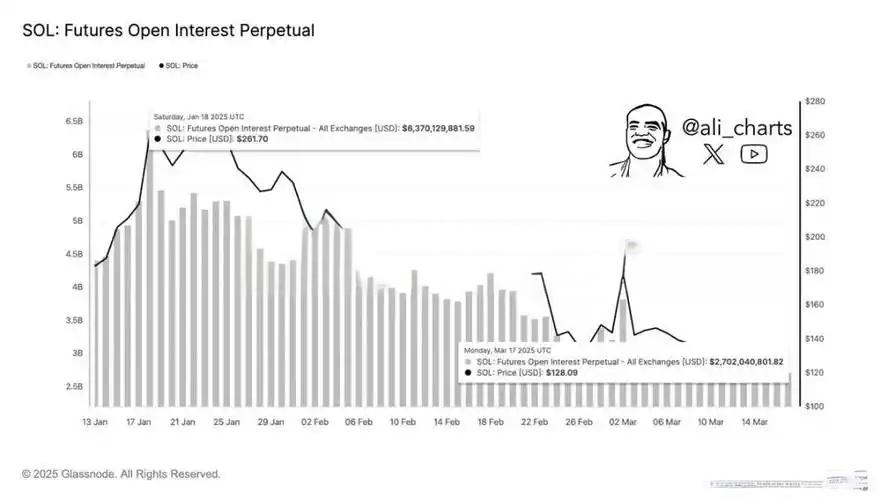

Volatility: Solana's price has fallen approximately 30% year-to-date, reflecting market volatility but also potential upside for leveraged products.

暂无评论内容