Grupo Supervielle基本情况

import matplotlib.pyplot as plt

Data for Grupo Supervielle

total_market_cap = 1300 # in millions

pe_ratio = 11.65

pb_ratio = 0.95

dividend_yield = 0.95 # in percentage

revenue_growth = 10 # in percentage

net_profit_growth = 8 # in percentage

Creating a bar chart for financial ratios

labels = ['PE Ratio', 'PB Ratio', 'Dividend Yield', 'Revenue Growth', 'Net Profit Growth']

values = [pe_ratio, pb_ratio, dividend_yield, revenue_growth, net_profit_growth]

x = range(len(labels))

width = 0.35

fig, ax = plt.subplots()

bars = ax.bar(x, values, width)

Adding labels and title

ax.set_xlabel('Financial Metrics')

ax.set_ylabel('Value')

ax.set_title('Financial Ratios of Grupo Supervielle')

ax.set_xticks([i + width / 2 for i in x])

ax.set_xticklabels(labels)

Adding data labels

def add_data_labels(bars):

for bar in bars:

yval = bar.get_height()

ax.text(bar.get_x() + bar.get_width()/2, yval, f'{yval}%', ha='center', va='bottom')

add_data_labels(bars)

plt.tight_layout()

plt.show()

Situation Introduction

Grupo Supervielle (SUPV) is a leading financial services group based in Argentina, with its main operations focused on banking and financial services. Founded in 1887, the company has a long-standing presence in the Argentine financial system. It provides services to individuals, small businesses, mid-market companies, and large corporations, including mutual fund services. The company went public on May 19, 2016, and has since established itself as a significant player in the financial sector. As of the latest data, Grupo Supervielle has a total market capitalization of $1.3 billion and employs over 5,264 people.

Shareholder Analysis

The company's share structure has shown stability over recent years. As of September 2024, the total equity capital stood at 913.45 million shares, with ordinary shares accounting for 456.72 million shares. The company has maintained a consistent pattern of share capital changes, primarily driven by regular reporting and treasury share acquisitions. For instance, there was a notable acquisition of treasury shares between December 31, 2022, and December 31, 2023, leading to a reduction in ordinary shares from 456.72 million to 442.67 million.

Operating Capability Analysis

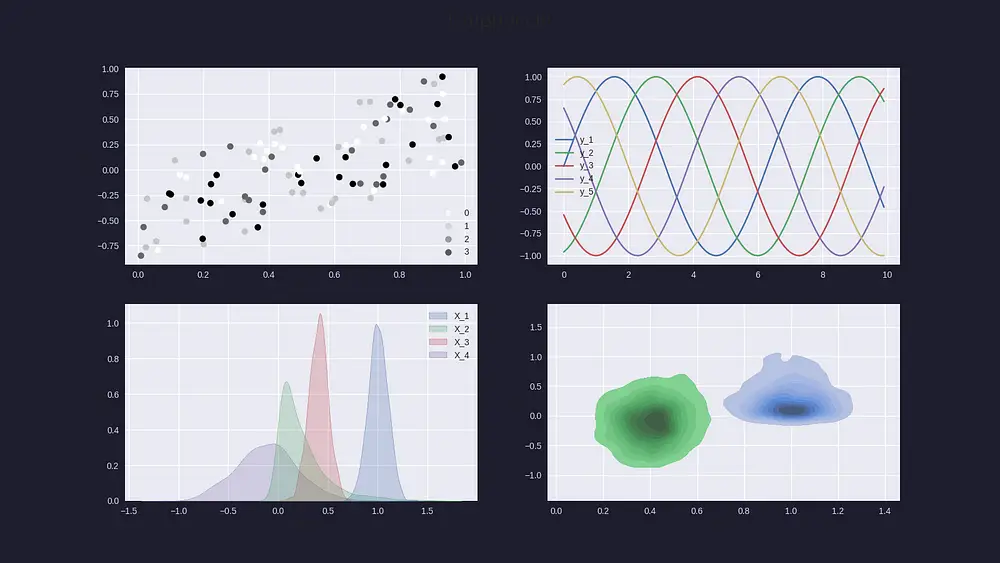

Grupo Supervielle has demonstrated robust financial performance, highlighted by its key financial ratios:

-

PE Ratio: 11.65, indicating a reasonable valuation relative to earnings.

-

PB Ratio: 0.95, suggesting that the stock trades below its book value.

-

Dividend Yield: 0.95%, reflecting a steady income stream for investors.

-

Revenue Growth: 10%, showcasing consistent top-line expansion.

-

Net Profit Growth: 8%, indicating strong profitability trends.

These metrics collectively underscore the company's ability to generate steady revenue and profit growth, alongside attractive shareholder returns. The chart below illustrates these financial ratios visually:

<

Competitive Capability Analysis

Grupo Supervielle holds a leading competitive position in several attractive segments of the Argentine financial market. The company's long history and deep integration within the local financial system provide it with significant competitive advantages. Additionally, its diverse service offerings cater to a broad customer base, from individuals to large corporations, which enhances its market resilience. The company's focus on innovation and customer-centric services further strengthens its competitive edge.

- 最新

- 最热

只看作者