Focus Universal基本情况

Situation Overview

Focus Universal Inc. (NASDAQ: FCUV) is a company specializing in IoT and 5G patent technology, founded in 2012 and headquartered in Ontario, Canada. The company focuses on developing hardware and software solutions for the IoT and 5G sectors, holding 28 patents and several pending trademarks. FCUV went public recently, with its stock experiencing significant volatility, including a 100%+ surge on its second trading day after an initial drop of over 23%.

Shareholder Analysis

The company's total equity has shown consistent growth, with the latest reported total equity standing at 7396.95 million shares as of December 2024. The share structure mainly consists of common stock, while details regarding preferred stock remain undisclosed. This structure suggests a focus on expanding common shareholder base, which may dilute earnings per share but could enhance liquidity and market presence.

Operating Capability Analysis

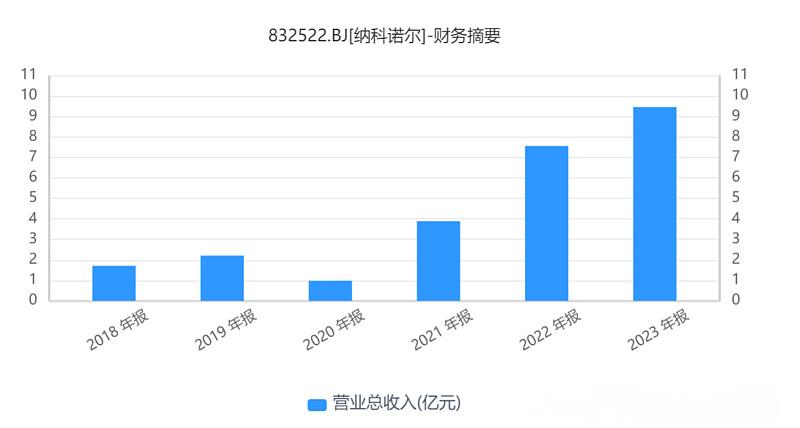

Focus Universal's operating capabilities are highlighted by its emphasis on R&D in IoT and 5G technologies. The company has developed five disruptive patent platforms, showcasing its innovation strength. Financially, its 2024 mid-year report indicates total assets of $1.231 million, with significant portions in cash, receivables, and inventory. This asset distribution reflects a balance between liquidity and operational readiness. However, the company's revenue growth and profitability remain areas to watch, given the high R&D expenditure.

Competitive Capability Analysis

FCUV's competitive edge lies in its patent portfolio and specialized technology platforms, addressing key challenges in IoT and 5G hardware/software design. However, the company operates in a highly competitive landscape dominated by tech giants and specialized firms. Its market share and brand recognition are still nascent compared to established players. The recent stock volatility indicates investor interest but also potential risks related to market positioning.

Development Scenario Analysis

The company's growth prospects are tied to the expanding IoT and 5G markets. Recent fundraising efforts, including a $120,000 direct offering at $0.32 per share, provide additional capital for R&D and market expansion. However, execution risks, such as technology commercialization and market adoption, remain. The stock's volatility post-IPO suggests investor optimism but also underscores the need for consistent performance to sustain growth.

Major Events

Key recent events include:

-

Successful completion of a $120,000 direct stock offering, marking a milestone in fundraising.

暂无评论内容