Virax Biolabs基本情况

Situation Introduction

Virax Biolabs Group Limited (NASDAQ: VRAX) is an innovative biotechnology company founded in 2013, headquartered in London. The company focuses on the development and distribution of diagnostic kits, medical technologies, and personal protective equipment (PPE) for the prevention, detection, and diagnosis of viral diseases, particularly in the field of immunology. Its product portfolio includes diagnostic test kits under the brand "ViraxClear," medical technologies and PPE products under "ViraxCare," and an upcoming immune analysis platform "Virax Immune" to assess individuals' immune risks against major viral diseases globally. The company went public on the NASDAQ in July 2022, raising $6.75 million through an IPO priced at $5 per share.

Shareholder Analysis

Virax Biolabs completed its IPO by issuing 1,350,000 shares at $5 per share, raising a total of $6.75 million. The shareholder structure post-IPO likely includes a mix of institutional and retail investors, though specific details on major shareholders or their holdings are not readily available in the provided sources. The company's relatively small IPO funding suggests a modest capital structure, which may influence its financial flexibility and growth potential.

Operating Capability Analysis

Virax Biolabs demonstrates strong operating capabilities through its innovative product development and market expansion. The company has launched diagnostic kits for diseases like monkeypox and herpes zoster, which gained significant market attention. For instance, the release of its monkeypox PCR kit led to a surge in its stock price, indicating strong investor confidence in its product pipeline. Additionally, the company has expanded its market presence by establishing a regional headquarters in the UAE to enhance its reach in the Middle East and North Africa regions.

Key operating metrics such as sales growth and market share in the diagnostic kit segment would provide deeper insights, but these specific figures are not available in the current data.

Competitive Capability Analysis

Virax Biolabs operates in a highly competitive biotechnology sector, facing rivals such as Applied DNA Sciences and Tonix Pharmaceuticals. The company's competitive strengths lie in its specialized diagnostic kits and focus on immunology. Its "ViraxClear" and "ViraxCare" brands offer unique value propositions in the market. However, the competitive landscape is challenging, with established players and emerging startups vying for market share. Factors such as technological innovation, cost-effectiveness, and strategic partnerships will determine Virax's long-term competitive position.

Development Scenario Analysis

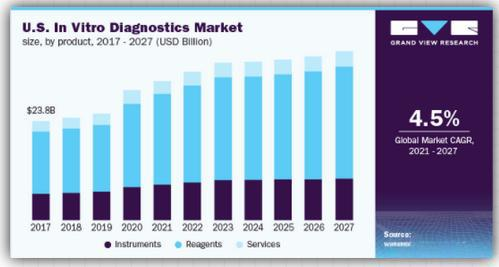

Virax Biolabs has a promising development scenario, driven by global health trends and its strategic initiatives. The ongoing focus on viral disease diagnostics, coupled with its expansion into new markets like the Middle East, positions the company for growth. The global demand for advanced diagnostic tools, especially in the wake of recent viral outbreaks, provides a favorable market environment. However, the company's relatively small scale and limited funding may pose challenges in scaling operations and competing with larger industry players.

Major Events

A significant event for Virax Biolabs was the launch of its monkeypox PCR kit in July 2022, which resulted in a substantial increase in its stock price, surging nearly 190% on one trading day. This event highlights the company's ability to capitalize on emerging health crises and underscores investor interest in its innovative solutions. Additionally, the company's establishment of a regional headquarters in the UAE signifies its ambition to expand its global footprint.

Summary of Company Basics

Virax Biolabs presents a compelling investment profile with its innovative products, strategic market expansion, and strong response to global health needs. However, its modest funding and competitive landscape pose challenges. Investors should consider the company's growth potential against its financial constraints and market positioning.

所属行业状况分析

import matplotlib.pyplot as plt

import numpy as np

Economic Cycle Data

economic_cycle_stages = ['Expansion', 'Peak', 'Contraction', 'Trough']

economic_cycle_values = [1.2, 1.0, 0.8, 0.6] # Hypothetical values representing economic activity levels

Life Cycle Data

life_cycle_stages = ['Introduction', 'Growth', 'Maturity', 'Decline']

暂无评论内容