Certara基本情况

Situation Introduction

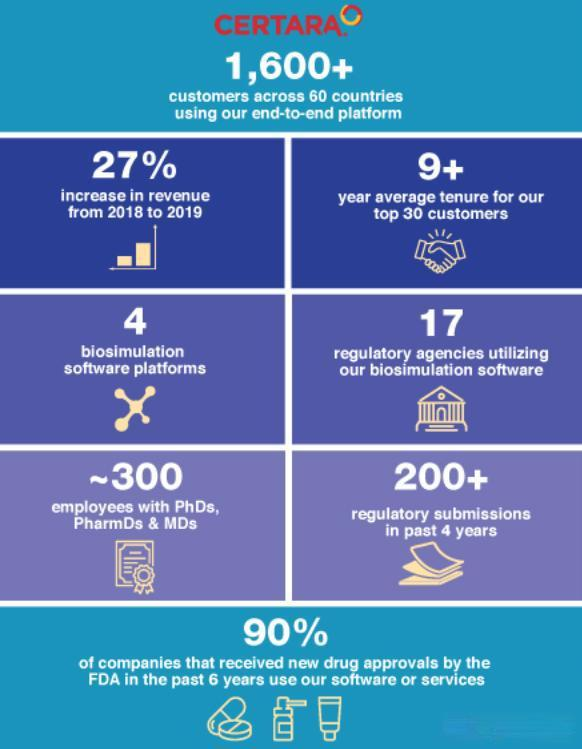

Certara (NASDAQ: CERT) is a leading company in the field of biosimulation, leveraging software and technology to accelerate drug development and delivery to patients. The company offers integrated end-to-end platforms, including modeling and simulation, regulatory science, and assessment software, to streamline the drug discovery and regulatory approval processes. Certara's solutions have been adopted by over 1,600 biopharmaceutical companies and academic institutions across 60 countries, including all top 35 biopharmaceutical companies by R&D spending. Its software has supported over 90% of FDA drug approvals since 2014.

Certara's IPO took place on December 11, 2020, with an initial offering price of $23, raising $668 million. The stock opened at $29.9 and closed at $38.08, representing a 65.57% increase over the issue price, valuing the company at $5.814 billion.

Shareholder Analysis

As of its IPO, Certara had several significant institutional shareholders holding more than 5% of the shares. The company's ownership structure includes a mix of venture capital firms, private equity investors, and strategic partners, reflecting a diversified investor base.

Operating Capability Analysis

Certara's operating capabilities are rooted in its cutting-edge biosimulation technology, which enables clients to predict drug performance and safety efficiently. The company's revenue streams are derived from software licensing, service contracts, and regulatory science solutions. Its key operating metrics include high client retention rates and a strong track record of supporting FDA approvals. Financially, Certara has demonstrated consistent revenue growth, underpinned by increasing demand for its integrated solutions.

Competitive Capability Analysis

Certara's competitive edge lies in its proprietary biosimulation software, including the Phoenix™ PK/PD and Simcyp™ PBPK Simulator platforms. These technologies are protected by patents, copyrights, and trademarks, creating a strong barrier to entry. The company's ability to integrate biosimulation with regulatory science differentiates it from competitors. Additionally, Certara's global presence and partnerships with top biopharmaceutical companies reinforce its market leadership.

Development Scenario Analysis

The global biosimulation market is projected to grow from $28.036 billion in 2023 to $61.01 billion by 2029, at a CAGR of 13.52%. This growth is driven by increasing R&D spending, regulatory support, and the adoption of AI in drug development. Certara is well-positioned to capitalize on this trend, given its established market presence and technological leadership. The company's strategic focus on expanding its software capabilities and entering new markets, such as Asia-Pacific, further enhances its growth prospects.

Major Events

Certara has been actively involved in strategic partnerships and technological advancements. For instance, its collaboration with regulatory agencies like the FDA, EMA, and China's NMPA highlights its role in shaping global drug development standards. Recent FDA initiatives to replace animal testing with AI-driven methods are expected to further boost demand for Certara's solutions.

暂无评论内容